TOYO TIRE Value creation

External Environment and Risks & Opportunities

We are aware of the risks and opportunities posed by the external macro environment in which the Medium-Term ’21 Plan was formulated and is being implemented, as well as the changes in the mobility field that are expected to occur by around 2030. We will work to create value along the entire value chain through our operations, products and services based on this awareness.

Awareness of the external macro environment (before 2025)

Significant changes in consumer behavior in the post-COVID-19 era

- Mindset: Home bound, budget-minded, avoiding person-to-person contact

- Behavior: EC/cashless purchases, changes in requested services

Increasing in geopolitical risks

- Decoupling trend continued, including competition for leadership between U.S. and China

- Economic disparities widening due to COVID-19 also aggravate populism

Aligning of social & environmental interests with economic interests accelerated

- Prioritization of employee/customer satisfaction increased

- Accelerated trend to align public interest with economic interests through customer-producer collaboration

Evolution and accelerated introduction of laborsaving technology

- Digital investment accelerated to make up for slow growth in worker headcount

- Advanced roles for humans as quality/quantity of data increased

Predicted changes in the mobility field (before 2030)

Growth of environmentally compliant/electric vehicles

Increased use of driverless transport and alternative transport services

Greater use of IT (mobility-related data linking)

Further diversification to meet individual needs and convenience

Risks & Opportunities

Opportunities

- Opportunities to increase demand through technological innovation and uniqueness in our EV response

- Opportunities to increase demand through technological innovation and uniqueness in our environmental response

- Opportunities in the solutions business

Products and services

- EV-specific/compatible tires

- Life cycle focused product development

- Highly durable/maintenance-free tires, airless tires

- Sensing

Risks

- Risks associated with climate-related measures

- Risk of not being able to secure a stable human resource base

- Risks associated with measures to uphold human rights in our operations and supply chain

- Risks of failing to ensure quality, including environmental compliance, throughout the value chain

- Risks associated with the growing demand for safety

Operations

- Improve energy efficiency and expand use of renewable energy

- Promote resource circulation and recycling

- Process assurance

- Tire safety awareness

- Human capital management

- Strengthen supplier engagement

- Responsible raw material procurement and traceability

- Individual management systems in the market

Value Creation Process

The Toyo Tire Group believes in the importance of organizing and disclosing our corporate philosophy, business model, governance, and business risks and opportunities to help promote a clearer understanding of the type of company we want to be in the future. As part of our value creation process, we have verbalized our six capitals, and defined the outputs generated through the utilization of these capitals and the outcomes that might impact stakeholders.

Our Strengths

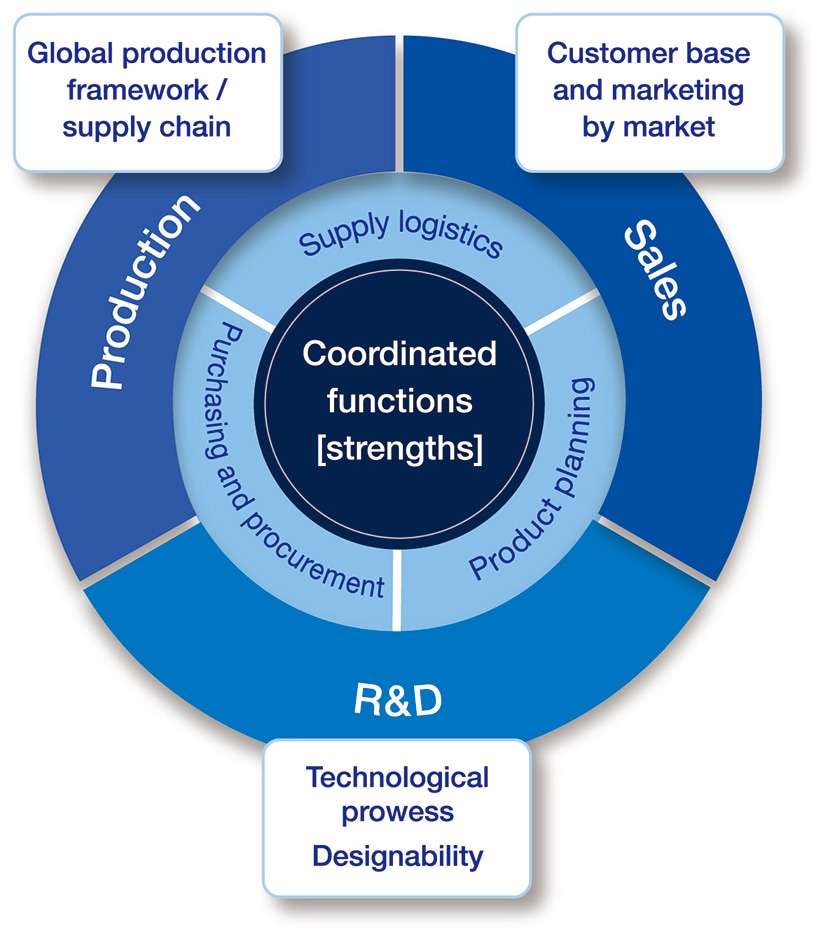

During the Medium-Term ’21 Plan, we have been working to bolster our ability to promptly and flexibly respond to changes through global collaboration.

(Production) Optimal global production and supply system

We are promoting local production for local consumption in markets where our production bases are located, while working to optimize the product mix and level production at each of our plants in order to increase our flexibility to respond to diversifying customer needs and changes in supply and demand. These efforts enable us to deliver products to our customers in a timely manner. For example, large-diameter tires for SUVs and pickup trucks, an area in which we excel, enjoy tremendous support in the North American market. In order to meet such demand, we are gradually increasing the production capacity at our U.S. plant and we have also renovated facilities at our Japanese plants and set aside capacity at our Serbia Factory, which opened in 2022, to fulfill supplies to North America.

Our strength also lies in the talent that enables us to respond flexibly to production. We are fostering talent based on the characteristics of each plant and the local conditions. At the same time, the size of the working population in Japan is declining and we need to ensure skill and know-how succession, an issue we are addressing by leveling operations and eliminating dependency on individual efforts or skills in coordination with enterprise resource planning (ERP) and through the introduction of new production systems. These initiatives are undertaken in line with our company-wide efforts toward data-driven management. We believe that leveling operations will also lead to greater diversity at production bases.

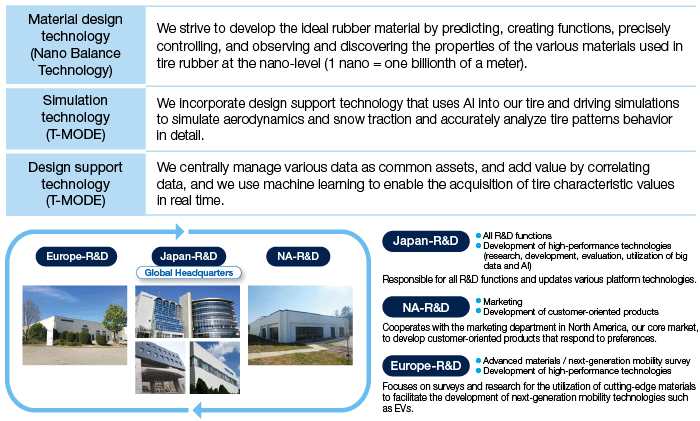

(R&D) Proprietary technology and tripolar R&D collaboration between Japan, the U.S. and Europe

The automotive industry is currently undergoing major transformations and tire development is also expected to quickly provide quantitative performance and functions to support the evolution of mobility. We are developing high-performance, high-quality products by linking our Nano Balance Technology, a proprietary platform technology for rubber materials, and T-MODE, a tire design platform technology, and we are constantly updating such proprietary technology. Our R&D functions in Japan, the U.S. and Europe each play a different role in our research and we are combining their results and collaborating with sales and production departments to develop highly functional and differentiated products that meet the needs of each market.

The use of artificial intelligence (AI) is becoming indispensable in the development of technology, such as T-MODE. We believe that it is essential for engineers to be able to explain the principles behind their designs and provide evidence to support their convictions, without over-relying on AI. We are working to train and improve the skills of our engineers so that they can use AI to expand their cognitive skills and capacity.

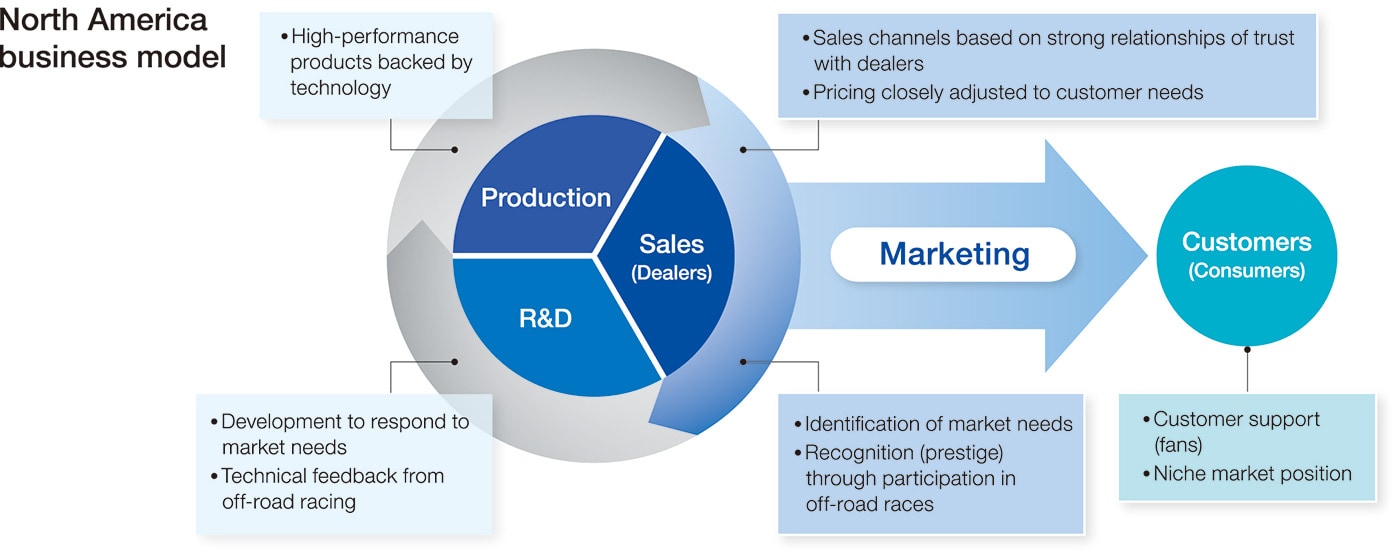

(Sales) Strong customer base built on advantages gained by not operating dealerships

The Toyo Tire Group does not operate any directly managed dealerships in order to sell our tires, making dealers our closest customers. We believe it is important not only to understand the actual need for the products that dealers want to deliver to consumers, but also to elicit and respond to the latent needs of dealers in terms of what kind of value-added proposals and services they expect from us. Our strength lies in our ability to accurately link our customers’ needs, which vary widely from market to market, with what we can offer, and in our ability to collaborate between small and agile functional organizations, and quickly adapt to information that comes directly from the market. Our North America business strategy has become an iconic business model for the Group’s tire business.

Our sales function is thoroughly aware of the need to correctly understand Toyo Tire’s position within the industry as well as our strengths and weaknesses in order to implement product and channel strategies.

(Product planning) Product planning to achieve the enjoyment of mobility for all

Product planning is one of the functions that plays a role in guiding company-wide value creation. Product planning takes the lead in discussions that overlap between production, sales, and R&D, and takes on issues requiring collaboration, that tend to be overlooked due to the specialized and independent nature of each function.

Rather than simply focusing on changes in mobility, market trends and interests, we strive to create and realize plans to make mobility more fun and interesting while ensuring the basic performance required of tires. This product planning stance has resulted in our unique, differentiated products. In particular, our strength lies in our ability to communicate with sales companies across the world on a daily basis. Such communication enables us to identify future trends and come up with product ideas, which we combine with the basic technology that our R&D function updates in anticipation of trends in the automotive industry and the level of performance and functionality required of tires, to create actual products. We believe that products created bearing in mind the various situations in which customers use tires can be sold not just as consumable items, but as luxury items that help achieve the enjoyment of mobility for all.

Sustainability

- Message from the President

- TOYO TIRE Value creation

- TOYO TIRE Sustainability

-

TOYO TIRE Materiality

- Help create a society of sustainable mobility / Support the enjoyment of mobility for all

- Support diverse talent with motivating challenges and job satisfaction

- Continue innovating next-generation mobility technology

- Pursue decarbonization in all corporate activities

- Promote supply chain sustainability

- Ensure the fundamentals of manufacturing: quality and safety

-

ESG Activities

- E: Environment

- S: Upholding human rights

- S: Managing occupational health and safety to global standards

- S: Crisis management (responding resiliently to natural disasters, infections and other crises)

- S: Working with local communities (Helping solve local issues)

- G: Sound governance

- G: Compliance

- G: Risk management

- G: Information security

- G: Promoting digital transformation (borderless and centralized business management through ERP reform)

- External Recognition

- Report Library

- ESG Data

- ESG Data/Survey Index

- GRI Content Index

- Communication on Progress (CoP) Index

- Editorial Policy