External Environment and Risks & Opportunities

We are aware of the risks and opportunities posed by changes in the business environment during the Medium-Term '21 Plan period and the predicted transformative trajectory of the mobility field through 2030. We will work to create value by adapting our products, services, and targeted initiatives to reflect these changes.

External environment

Politics and economics

- Expansion of geopolitical risks

- Accelerated nationalism caused by economic disparity, decline of international cooperation

- Fluctuating resource prices

- Aligning of economic interests with social & environmental interests accelerated

Environment

- Accelerating decarbonization

- Transition to a circular economy

- Measures to prevent plastic pollution

- Growing interest in natural capital

Society

- Accelerated digital investment to offset declining working populations, humans expected to play increasingly sophisticated roles

- Growing interest in human capital

- Upholding human rights in business

- Quality governance in manufacturing

Changes in the mobility field

- Reducing CO2 emissions to achieve carbon neutrality using various options

- Greater use of IT (mobility-related data linking)

- Diversification of functions to meet the needs of individual users and offer greater convenience

- Increased use of driverless transport and alternative transport services

Risks & Opportunities

Opportunity

- Expanding demand inspired by technological innovations progressing the environmental performance of automobiles, and unique added features

- Expanding demand for commercial vehicles that help solve environmental and social issues in the logistics industry

- Demand for maintenance-free features in next-generation transportation services

- Generating innovation through enhanced talent development

Risk

- Stricter environmental regulations on automobiles and business activities

- Increasingly intense competition for securing talent

- Environmental impacts and human rights violations in the supply chain

- Progress of stronger product safety-related regulations

Creating value through awareness of risks and opportunities

Products and services

- Products that focus on reducing CO2 emissions and circulating resources during their lifecycle (passenger/commercial vehicles)

- Highly durable (wear resistant)/maintenance-free tires, airless tires

- Sensing, tire wear diagnoses

Strengthen platforms

- Human capital management, health management

- Technological development to promote resource circulation and recycling

Risk management

- Improve energy efficiency, expand renewable energy use

- Responsible raw material procurement and traceability

- Supplier engagement

- Strengthen quality throughout the value chain

(a process assurance system, an individual product management system in the market, and tire safety awareness programs for users)

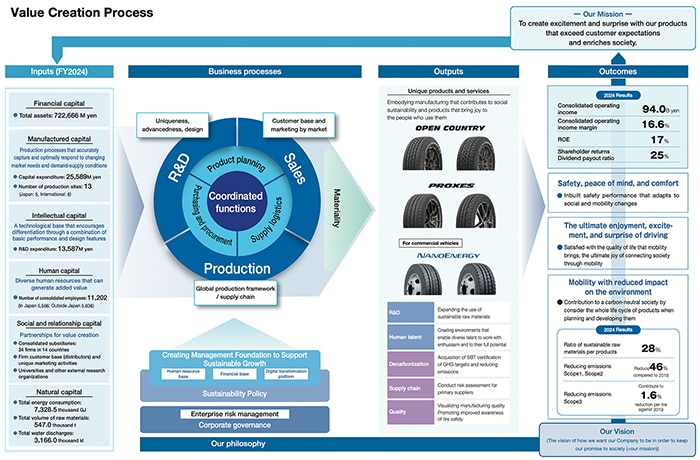

Value Creation Process

The Toyo Tire Group believes in the importance of organizing and disclosing our corporate philosophy, business model, governance, and business risks and opportunities to help promote a clearer understanding of the type of company we want to be in the future. As part of our value creation process, we have verbalized our six capitals, and defined the outputs generated through the utilization of these capitals and the outcomes that might impact stakeholders.

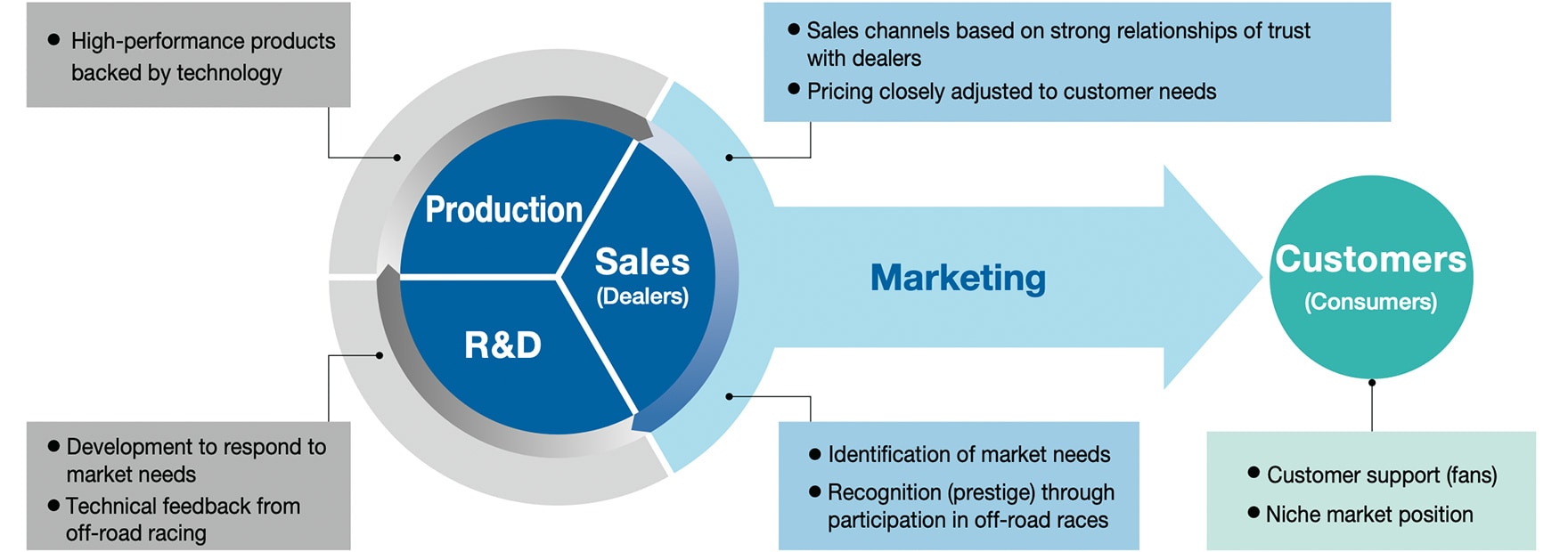

High-quality business management through the strengthening of collaboration in functional organizations

In 2017, Toyo Tire Corporation reformed the individual business-based organization that had been in place since its founding and shifted to a flat, function-based organizational structure. Then, in 2018, we decisively transformed ourselves into a management structure that positioned the mobility-related fields of automotive tires and automotive parts at the core of our business. This helped establish a solid foundation for promoting high-quality business management by coordinating all production, sales, R&D and corporate functions. Some negative factors were pointed out regarding the function-based organizational structure, such as the possibility of unclear responsibilities and lack of comprehensive perspective. However, we set ourselves the task in the Medium-Term '21 Plan to bolster our ability to promptly and flexibly respond to changes through global collaboration, and have worked to promote business based on management that offsets any negative factors and fully capitalizes on the positive elements of a function-based organizational structure.

Product Strategy

Product planning that facilitates differentiation

We plan new and updated products based on individual regional growth strategies and the annual rolling over of a medium-term product plan that runs on a five-year cycle. When executing the plan, the product planning function conducts proactive market research together with the technical services and sales functions, plans and formulates new product direction by heeding information acquired from industry participants at various car events and other gatherings, and conceptualizes and creates products after showing the ideas to dealers and holding repeated discussions. This proposal-based style helps drive the creation of highly differentiated products. The product planning function propels this differentiation strategy by embracing both the R&D function's focus on next-generation mobility trends and the sales function's focus on market trends and championing the company's commitment to creating and realizing plans that make mobility more fun and interesting.

In particular, when planning products for our major North American market, local sales subsidiaries gain an attentive grasp of user trends through customer workshops and other means, which they swiftly share with relevant departments in Japan and the U.S. to facilitate timely commercialization. Since we do not have any directly managed dealerships, we build relationships of trust and customer loyalty by steadily lending shape to the ideas of our dealers. These efforts have helped establish our current presence and profits in the North American market. As customer needs continue to diversify, we will aim to further enhance our brand value by creating unique products inspired by earnest customer engagement.

Marketing activities

Our marketing activities are tailored to the interests of a wide range of users. For car and motorsports fans, we try to appeal tire performance and improve brand recognition by advertising our multiple racing achievements. We also use promotional activities featuring famous rally drivers as brand ambassadors. This helps build brand trust more effectively by encouraging respected individuals to communicate the appeal of our products along with their feelings as a driver.

We adopt a unique approach to users who are sensitive to latest trends and whose tastes and preferences tend to be reflected in their choice of tires. For example, we have been focusing on camping, which has attracted much more attention in recent years, and using social media to promote high designability off-road tires to people who want to use vehicles for these outdoor activities. In Japan, an Instagram post of a car with OPEN COUNTRY brand tires encouraged a community for women who enjoy customizing their beloved cars. We have been able to steadily expand our fan base by holding regular meetings and other meetings that enable fans to directly sense the appeal of the OPEN COUNTRY brand.

Spellbinding talk by our ambassador driver at TOKYO AUTO SALON 2025

(Left: Masato Kawabata / Right: Mad Mike)

Open Country Women's Association meet

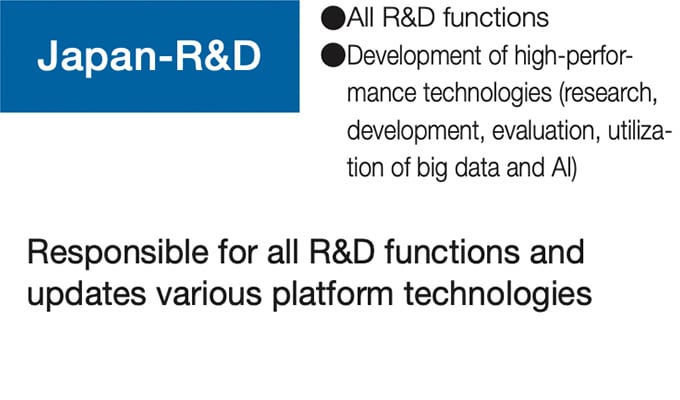

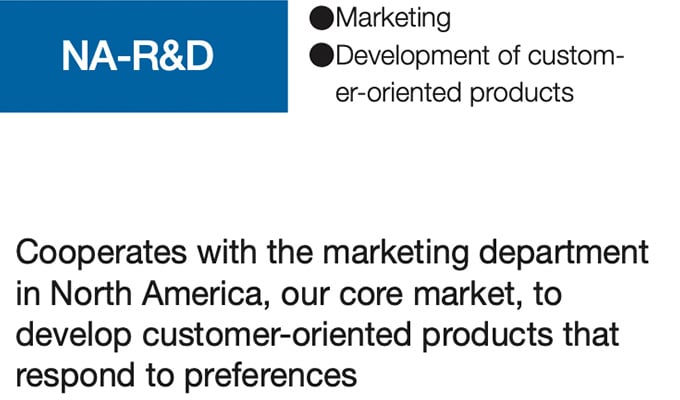

Technical Strategy

Enhance potential value-creating proprietary technologies

High-performance design capabilities

The automobile industry is undergoing a period of major change, so the tire industry is also expected to realize swift performance and functionality advancements that underpin the evolution of mobility. Toyo Tire Corporation develops products based on the tandem pursuit of two proprietary platform technologies, Nano Balance Technology for fundamental material design and T-MODE for simulations and tire design support, both of which are being constantly updated.

Customer-oriented product capabilities

- Balancing functionality and design

At Toyo Tire Corporation, we ensure that product development is firmly backed by technology, theory and data, but we also think it is extremely important to attentively heed market feedback to ascertain how best to meet customer needs. Information on market needs from frontline operations is collected by the sales function and shared with the R&D function in a timely manner. We also actively create opportunities for engineers to go directly to the market and foster a keen customer perspective, propelling the development of differentiated products. The aggressive tread patterns preferred by our primary target customers can sometimes affect basic performance and complicate development. However, we have been able to achieve a high degree of balance between functionality and design in the initial stages of virtual simulations by leveraging the platform technologies that we have updated continuously. We will continue to accumulate these types of data to further enhance customer-oriented product creation.

- A.T.O.M.: Advanced Tire Operation Module

We began mass production using A.T.O.M. in the early 2000s using a unique Toyo Tire manufacturing method in which rubber spun into a thin strip roughly 15mm wide is wound around a rotating molding drum and then bonded together to manufacture the necessary tire parts. In tire manufacturing, it is common to shape wide treads and other tire parts around a drum and glue the two ends together. However, any increase in the weight of the bonded parts can cause a shift in the tire's center of gravity, and the larger the tire, the greater the deviation, making balance adjustment an issue. A.T.O.M does not produce any large joint portion, so has a minimal impact on tire balance. Another appealing benefit of A.T.O.M. is that it makes it relatively easy to increase the thickness of the rubber on one side of the tread, facilitating the addition of grooves on the sidewall as well. Indeed, A.T.O.M could be described as the source of our strength in high design performance for large-diameter tires.

Connecting global R&D centres

We combine the results of individual research responsibilities at our R&D centres in Japan, the United States and Europe to generate market-tailored product development in cooperation with the sales and production functions.

As part of the steady consolidation of our sales functions in Europe started in 2024, we are considering transferring some of the European R&D functions to our tire production site in Serbia. We believe we will be able to better respond to increasingly stringent laws, regulations and standards in the European region by leveraging production base facilities to better direct the results of advanced materials research, traditionally managed by our European R&D center, into improving processing technology, and by speedily conducting driving tests of actual vehicles fitted with our tires on the proving ground adjacent to the factory.

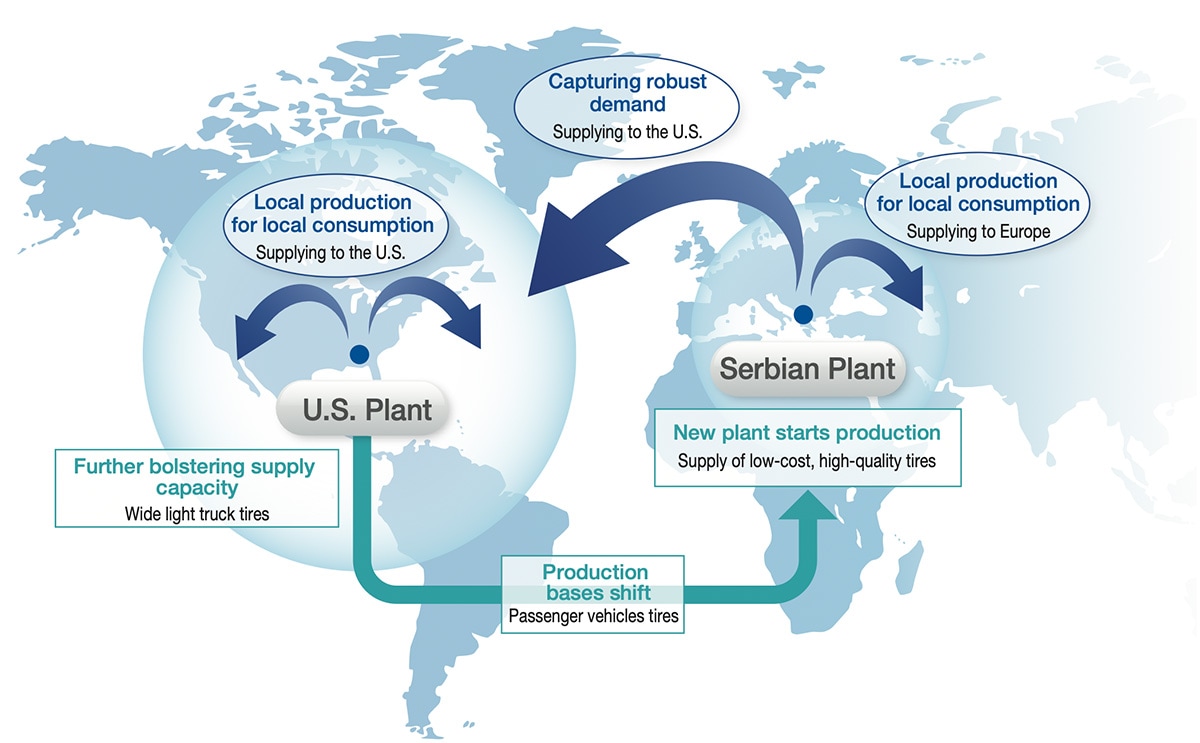

Production and Supply Strategy

Allocations aligned to market trends

While each plant supplies its local market as a priority, our production setup is designed in such a way that multiple plants can produce and supply some of the products intended for markets in other regions. Since we established our first tire production plant outside Japan in the U.S. in 2004, we have been building our new plants and refurbished existing plants so that their production processes are able to ensure equivalence in the specifications and performance of certain product lineups between different plants no matter what differences there were in terms of facilities, equipment and materials used. For example, large-diameter tires for large SUVs and pick-up trucks, a product category in which we have a strong competitive edge, can be produced not only at our U.S. plant but also at our Japan and Serbia plants for shipments to the North American market.

On top of that, the SCM Division in Japan links up and coordinates the production and other relevant functions to adjust supplies between markets based on market trend data provided by the sales function. By centralizing the control of different functions in Japan, we are ensuring smooth operations on the global level and enabling adjustments to ensure balanced levels of profitability across the plants. This way we are able to maximize our plants' know-how in high-mix, low-volume production and create a highly profitable production setup that is resilient in the face of demand fluctuations.

The precisely controlled allocation of production and supply enables us to meet the increasingly diverse needs of customers and expand opportunities by improving customer satisfaction. It is also a powerful tool for avoiding or minimizing geopolitical risks and negative impacts of national governments' economic policies.

Sales Strategy

North American business model

The Toyo Tire Group has invested various management resources in the North American market since establishing its tire production base in the State of Georgia in 2004. In the United States, where automobiles are not just a means of transportation, but an integral part of cultures and lifestyles, we have focused on large-diameter tires for light trucks (large SUVs and pickup trucks) because those products are in high demand in the Sun Belt region, the southwestern part of the United States. More specifically, we have targeted users that prize individuality, consistently promoting and introducing tires that offer the volume, robustness and design that those users expect.

Since the Toyo Tire Group does not operate any directly managed dealerships, our dealers are our closest customers, and it is through them that we gain a firm grasp of market trends and needs. Instead of simply ascertaining our dealers' actual needs in terms of the products they want to offer end users, our sales function also conducts various marketing-type sales activities that explore latent needs for added value such as the kind of proposals and services each individual dealer really wants us to offer. We have built a unique and powerful customer base by pursuing sales activities that intricately link the things our customers desire and what we can and should deliver. We are also working with our R&D function and product planning function to increase brand awareness through our ongoing participation in America's biggest off-road races. The synergies generated by these activities have enabled us to capture and retain a dominant share in the niche market of tires over a certain number of inches in the United States, which is generating a significant revenue stream. However, far from becoming complacent, we have been taking steps to significantly reorganize our sales channels, while also assessing structural changes in the broader market and customer expectations of the company.

In recent years, we have seen a string of new competitors enter this segment, and a steady flow of low-priced products enter the North American market as a whole. However, our product capabilities and brand power, which are backed by firm bonds of trust with dealers cultivated over more than 20 years, have proved key strengths for the Toyo Tire Group and true assets for upholding our presence in the North American market. To translate these strengths into even stronger results, we will continue to invest in our production capacity and technological capabilities, strengthen branding, and refine our business model to build stronger resilience in fluctuating market conditions.