Challenge

- Corporate management that responds to social demands, is valued, and carries high expectations

- Encouraging a healthy corporate culture and business practices

Our policy

The Toyo Tire Group practices the principles of Japan’s Corporate Governance Code in an appropriate fashion to ensure effective corporate governance. We seek to ensure the rights and equal treatment of shareholders and to appropriately cooperate and engage in dialogue with our other stakeholders. We strive to make appropriate information disclosure and ensure transparency to help achieve those aims. The Board of Directors is accountable to the Company’s shareholders and, as such, strives to appropriately execute its roles and responsibilities in order to enhance profitability and capital efficiency and, by extension, achieve the Company’s sustainable growth and increase corporate value over the medium to long term.

We practice the ideals set forth in our Company Philosophy, Mission, Vision, and Fundamental Values, which together make up our philosophy framework. In order to meet the expectations of our stakeholders and improve our corporate value, we seek to ensure management transparency and efficiency, work to maintain and build appropriate management systems, and endeavor to further strengthen our corporate governance, internal control systems, and compliance.

As part of our efforts to strengthen compliance, which we consider to be the essential element that embodies our philosophy, we established the Toyo Tire Group Charter of Corporate Behavior as a set of common principles to help all Group companies conduct sincere business activities. We also formulated the Toyo Tire Group Code of Conduct to assist all executives and employees in implementing the Charter of Corporate Behavior, and seek to instill that code across the whole Group. The Charter of Corporate Behavior and the Code of Conduct are reviewed when appropriate and any necessary revisions are resolved upon by the Board of Directors.

Responsible executive (as of April 2025)

Corporate Officer and Vice President of the Corporate Headquarters

Organizational responsibilities (as of April 2025)

Governance structure

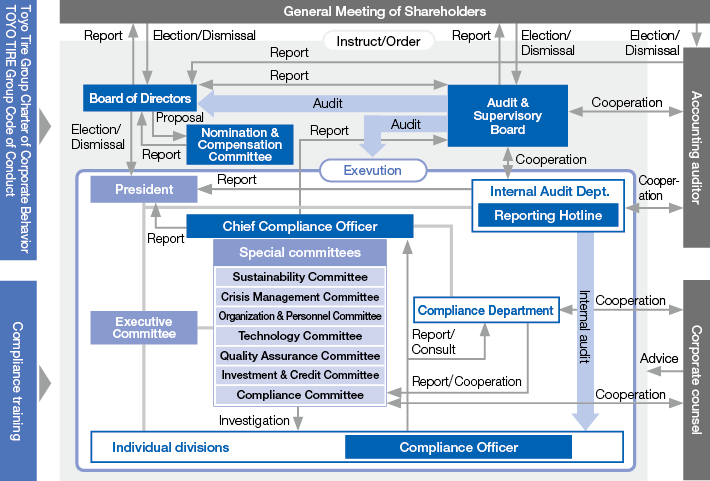

Our corporate governance system consists of the Board of Directors, which is responsible for decision-making and supervisory functions, and, under that, the Nomination & Compensation Committee, which acts as an advisory body to the Board of Directors on personnel affairs, compensation and other matters pertaining to directors.

We also have an Executive Committee that makes decisions on business execution, under which various special committees that deliberate and consult on individual fields. Additionally, we have an Audit & Supervisory Board that audits the Board of Directors and the execution of directors’ duties. This system enables all these functions to be fully exercised.

The Board of Directors meets, in principle, once a month to supervise the execution of duties by directors and decide important matters, including the appointment of the representative director and executive directors, determination of basic management policies, approval of important investment plans, determination or approval of the convening of general meetings of shareholders, agenda items to be presented and the proposals and documents to be submitted (including financial statements and supplementary statements) at the general meeting of shareholders, and to hear reports on the status of business execution. Outside directors attend Board meetings, where they actively exchange opinions, and monitor and supervise management. The Board of Directors also receives regular reports on important management risks debated in the Executive Committee and the Sustainability Committee, supervises risk management and assesses its effectiveness.

The Nomination & Compensation Committee, which acts as an advisory body to the Board of Directors, met three times in fiscal 2024 to discuss executive candidates, executive compensation policies, and the amount of executive compensation, and to give advice, recommendations, and reports to the Board of Directors.

We have introduced a monetary compensation scheme that involves the granting of transfer-restricted shares to internal directors as an incentive to consistently improve our corporate value and to promote a deeper sense of shared value with our shareholders.

We also manage any conflicts of interest in an appropriate manner. The outside directors we appointed are judged to have no conflicts of interest with general shareholders and have been registered as independent officers with the stock exchange. We commission regular external evaluations of the Board of Directors to ensure the Board and the various committees function well and effectively.

Governance structure (as of April 2025)

- * The name was changed from Crisis Management Committee on January 1, 2025.

| Name | No. of meetings per year | Chair | Role/duties |

|---|---|---|---|

| Audit & Supervisory Board | 14 | Standing Audit & Supervisory Board member (specific company auditor) | Audits the execution of business by the Board of Directors and directors |

| Board of Directors | 17 | Chairman of the Board | Decision-making and supervisory body |

| Executive Committee | 25 | President | Executive decision-making body |

| Sustainability Committee | 4 | President | Deliberates policies and strategies to strengthen and promote sustainability management and responses to the key sustainability-related issues of Toyo Tire Corporation and Group companies |

| Compliance Committee | 4 | Chief Compliance Officer | Deliberates and investigates ways to promote, enhance and strengthen compliance at Toyo Tire Corporation and Group companies |

| Crisis Management Committee*1 | 4 | Vice president in charge of crisis management*2 | Deliberates agenda items concerning planning and management of measures against crises |

| Organization & Personnel Committee | 12 | President | Deliberates key issues related to the organization and human resources |

| Technical Committee | 12 | Vice president of R&D headquarters | Deliberates important issues related to R&D (strengthening of our core competence technologies, that are our platform technology and leading technology, to realize the Group’s management vision and medium-term business plans, as well as important issues relating to technology in general |

| Quality Assurance Committee | 4 | Vice president of Quality Assurance, Environment and Safety Headquarters | Establishes basic policies and measures to promote and operate a unified quality assurance system across Toyo Tire Corporation and Group companies; deliberates responses to serious quality issues and implements policies, plans and other measures in departments responsible for quality assurance and other relevant divisions |

| Investment & Credit Committee | 26 | General manager of Corporate

Administration Division |

Deliberates the investments and credit of Toyo Tire Corporation and Group companies |

- *1 Changed name to Risk Management Committee on January 1, 2025.

- *2 Changed name to vice president in charge of risk management from January 1, 2025.

Internal control systems

We determine our basic policy for building internal control systems at Board of the Directors meetings and then put appropriate systems in place. We review the basic policy each year to reflect changes in our business environment and other factors. The Board of Directors resolves any reviewed items as we strive to develop and operate more effective internal control systems.

The Toyo Tire Group has been operating a whistleblowing system since 2006. We have set up whistleblowing hotlines through which Group employees can report or consult directly on compliance matters and other concerns that they fear could develop into a crisis event. The hotlines can be accessed through multiple channels, and they also accept anonymous reports as well as reports from former employees, suppliers and customers to make it easier to raise the required information to the right governance bodies.

- * Toyo Tire Corporation

- * The name was changed from Crisis Management Committee on January 1, 2025.

Reporting systems

- Reporting hotline (whistle-blowing system): For executives, employees and suppliers

- Customer Relations Department: For customers (consumers) and local communities

- Online inquiry form: for customers (consumers), shareholders and investors, and local communities

- IR meetings: For shareholders and investors

Main resources for promoting activities (2024)

- Total executive compensation (2024)

- Directors (8): 272 million yen *Maximum annual limit: 450 million yen

- Audit & Supervisory Board members (7): 65 million yen *Maximum annual limit: 80 million yen

- * The above numbers of executives and total compensation include a total compensation of 70 million yen for eight outside officers (outside directors and outside Audit & Supervisory Board members).

- * The above figures also include compensation for two Audit & Supervisory Board members (including one outside member) who left in fiscal 2024.

- * The total amount of compensation above includes 100 million yen provision for officers’ bonuses allocated in 2024.

- * The total amount of compensation for directors above includes a 10 million yen compensation for the purpose of granting transfer-restricted shares.

Corporate governance

Instilling our philosophy

Since establishing our philosophy in 2017, we have been working on ways to instill it in our executives and employees so that it forms the central core of their work.

Our philosophy puts into words the thoughts and beliefs that we value as a Group. It is structured with our Company Philosophy as the overarching concept that embodies our valued founding spirit that we shall continue carrying forward into the future. This is followed by Our Mission that defines our purpose within society, and then Our Vision that details the company we aim to be in order to achieve this purpose. Finally, the philosophy sets forth Our Fundamental Values as the foundation for ideas that we expect both our executives and employees to value equally.

We have also clearly indicated in our new Medium-term ’21 Plan, announced in February 2021, that the management plan itself was created to fulfill the company’s purpose of realizing this philosophy.

To continuously instill our philosophy in employees, we include a lecture on it in all initial internal training programs.

Having explained the background of how our Philosophy was formulated and the history of the company, we give a lecture to deepen understanding of our philosophical framework. In level-specific training for newly promoted managers, a workshop is held along with the lecture to ensure any recognition of the company’s own strengths and challenges helps improve participants’ own conduct. The training is given at each stage of employees’ career progression, from junior to mid-career employees, managers, and general managers. This means that the challenges identified by junior and mid-career staff are examined as themes for managers and general managers to tackle. The program design ensures consistency across all levels, and encourages employees to consider how best to embody the Philosophy and align it with their individual roles and positions.

Moving forward, we will continue creating opportunities such as group work for employees in different positions and at different levels to consider how they can embody our philosophy in their workplaces.

Board of Directors’ initiatives

The Board of Directors comprises eight directors (including four outside directors) and is responsible for deciding important matters such as management policies, targets and strategies, and overseeing the directors’ performance of their duties.

Specifically, the Board of Directors appoints the representative director and executive directors, determines basic management policies, approves important investment plans, determines or approves the convening of general meetings of shareholders, agenda items to be presented and the proposals and documents to be submitted (including financial statements and supplementary statements) at the general meeting of shareholders, and reports on the performance of directors’ duties. The Board met 17 times in 2024, including extraordinary meetings. Outside directors also attend Board meetings and other important meetings to encourage an active exchange of opinions and effectively monitor and supervise management activities.

The Board of Directors also receives regular reports on important risks to the Company’s management that have been debated in and reported to the Executive Committee and each special committee in order to oversee risk management and assess its effectiveness.

Assessing the effectiveness of the Board

As part of our effort to promote sustainable growth and improve corporate value in the medium to long term, we have been conducting an annual analysis and assessment of the operation, composition and activities of the Board of Directors since 2017, with the aim of improving the Board’s functionality. In order to ensure fairness, we use a third-party body to aggregate and evaluate survey results.

The main updates made this year relate to the assessment criteria. To complement the current criteria, we have added questions related to digital transformation (DX), which is also listed in the Medium-Term ’21 Plan, as one of the fundamental management pillars supporting the sustainable growth of the Company.

Overview of assessment

| Assessment subject | Self-assessment by directors and auditors, with third-party evaluation |

| Methodology | Questionnaire (19 questions) |

| Questionnaire design | Five-point scale scoring with comment field for each question |

| Assessment criteria | 1.Composition and operation of Board of Directors (10 questions)

→ Board size, composition, operational status, quality of information provided, etc. 2.Management strategy & management planning (5 questions) →Discussions and the level of contribution surrounding the forming of strategy and overall direction, sustainability initiatives based on risks and opportunities, reports and discussions related to the promotion of DX, etc. 3.Risk management (2 questions) →Encouraging a measured risk-taking approach, supervising management, etc. 4.Overall assessment (2 questions) |

Assessment process

| Previous year | Around December | Review assessment methodology |

| This year | Mid-January | Survey directors and auditors |

| Early March | Aggregation and feedback of evaluation results by third-party body | |

| Late March | Report to Board of Directors and consider next course of action |

Overview of FY2024 assessment results and next course of action

Most of the assessment results have been positive, and improvements have been made in areas where issues were raised in the last year, which suggest that the Board of Directors as a whole is functioning effectively. The third-party evaluation has also confirmed that our Board of Directors is functioning properly in general, and that it is structured in a way that assures effectiveness.

Among the individual assessment criteria, management supervision was once again highly evaluated. The situation regarding the quality and timing of information provision, which has been an issue in the past, was judged to be improving in terms of quality with the provision of enhanced reporting on business execution. With regard to the timing of information sharing, we have further accelerated the provision of advance materials for Board meetings, and are constantly working to improve the ways in which we provide information.

Some people felt that, while the Board ensures members can voice their opinions freely and frankly, more effort is needed to stimulate vigorous debate. We will consider how to secure sufficient time for deliberation, provide the best explanations, and prepare the best materials for clarifying the content of items requiring discussion.

With regard to the newly added questions on reporting and discussion on DX promotion, we have already acknowledged the need for further discussion on how to best utilize DX in the future. We are currently striving to secure opportunities for deliberating these issues and considering appropriate responses.

Nomination & Compensation Committee

We have established a Nomination & Compensation Committee as an advisory body to the Board of Directors to strengthen the independence, objectivity and accountability of the Board with respect to the appointment and compensation of directors, and to further enhance our corporate governance system.

The Nomination & Compensation Committee, which consists of six directors (including four outside directors), met three times in fiscal 2024 to deliberate on matters such as the appointment, dismissal, and remuneration of directors, and to provide advice, recommendations, and reports to the Board of Directors. The Committee includes three or more directors appointed by resolution of the Board of Directors. The majority of members are outside directors, and the chair is appointed from among the committee members by resolution of the Board.

Audit & Supervisory Board

The Audit & Supervisory Board comprises five members including three outside directors and reports on, discusses and resolves on important matters concerning auditing.

The members of the Audit & Supervisory Board attend the meetings of the Board of Directors and the Executive Committee as well as other important meetings, where they raise issues as required, check whether the Company’s business is executed appropriately, and improve the effectiveness of audits.

Engaging in dialogue with shareholders and investors

Toyo Tire Corporation holds an annual general meeting of shareholders, and quarterly financial results briefings. Top management conveys its opinions on performance trends, business environments and future outlook for the Group to institutional investors and securities analysts when we announce interim and full-year business results. In addition to these activities, we also seek to promote understanding of Group strategy by creating multiple opportunities for the company president and other senior executives to engage in a dialogue on the issues that interest institutional investors and securities analysts, and providing quarterly opportunities (individual interviews) for investors to communicate and ask questions of IR staff. We also respond proactively to dialogue requests from institutional investors around the world either in the form of individual interviews or conferences.

In 2024, senior executives engaged with shareholders and other institutional investors and securities analysts on six occasions, with 87 attendees from 76 institutions, and IR staff responded to requests for individual interviews with 418 attendees from 280 institutions. In October, we held our first ESG briefing via web conferencing, which provided an opportunity to promote fruitful discussion between institutional investors and securities analysts and relevant Company officers. At the briefing, the Integrated Report, which had been updated and published in July of the same year, was used as a common point of reference, encouraging an exchange of views on material issues, governance, and other ESG-related activities.

Moreover, our Shareholder Relations (SR) staff continues to engage in dialogue with shareholders, including institutional investors in Japan, focusing on topics such as our governance structure and sustainability initiatives. Opinions and requests obtained through such dialogue are promptly fed back to the company, leading to improvements, such as the enhancement of disclosed information.

Enhancing our communication tools

We are working to improve the way we convey corporate results and various other materials and the way we display information on our IR website in order to disseminate comprehensive management information on Group business strategy, targets, current initiatives and other matters in a prompt and readily understandable manner.

We publish an integrated report every year as a tool to help institutional investors, securities analysts, and our many other stakeholders around the world understand and gain interest in the Group.

In October 2024, we held our first ESG briefing via web conferencing, which provided an opportunity to promote fruitful discussion between institutional investors, securities analysts, and relevant Company officers. At the briefing, the Integrated Report, which had been updated and published in July of the same year, was used as a common point of reference, encouraging an exchange of views on material issues, governance, and other ESG-related activities.