Reinforcement of Corporate Governance and Compliance

- Issues to be addressed

- Guiding Policies

- Global Anti-corruption and Anti-bribery policy (Additional information in January 2019)

- TOYO TIRE’s SDGs (Ideal Status in 2030)

- Goals

- Responsibilities (April 2021)

- Activity Promotion System (April 2021)

- Grievance Mechanism

- Main Resources

- Activities in 2020

Issues to be addressed

- Reinforcing corporate governance

- Further spreading awareness of placing greatest priority on compliance

We are living in a time when the future outlook is increasingly uncertain, what with climate change, the changing demographic structure, and infectious diseases that spread globally. In order to sustain international business growth as we strive to survive the “once-in-a-century” change in the auto industry, we at TOYO TIRE believe it essential to ensure management transparency and pursue fairness within the organization. To this end, we recognize that we have a responsibility to various stakeholders, and it is necessary to maintain an appropriate management system and increase awareness that compliance is the most important issue, and we have positioned these as issues that should be addressed with priority.

Affected Stakeholders

Directly: Employees

Employees: Local Communities, Shareholders and Investors, Creditors

Guiding Policies

We properly implement the principles of the corporate governance code in order to implement effective corporate governance.

For us to faithfully conduct business activities to realize a sustainable society, "constantly benefiting society by being fair in what we do" is the primary criteria for action in our corporate philosophy, and we have revised the Toyo Tire Group Charter of Corporate Behavior, the corporate action principles applied uniformly across the Group, to reflect this. We have also established the Toyo Tire Group Code of Conduct for each and every director and employee to put the Charter into practice, and made efforts to spread the Code across the Group.

- Basic policy on corporate governance(Corporate Governance Report, Japanese only)

- Toyo Tire Group Charter of Corporate Behavior

- Toyo Tire Group Code of Conduct

Global Anti-corruption and Anti-bribery policy (Additional information in January 2019)

TOYO TIRE’s SDGs (Ideal Status in 2030)

- We will contribute to minimize social impact of extreme weather phenomena derived from climate change by building a robust value chain.

Goals

We will increase the transparency of management and aim to implement highly specialized, effective corporate governance by spreading awareness of the corporate philosophy and improving compliance levels.

Responsibilities (April 2021)

Corporate Officer & Vice President of Corporate Headquarters

Activity Promotion System (April 2021)

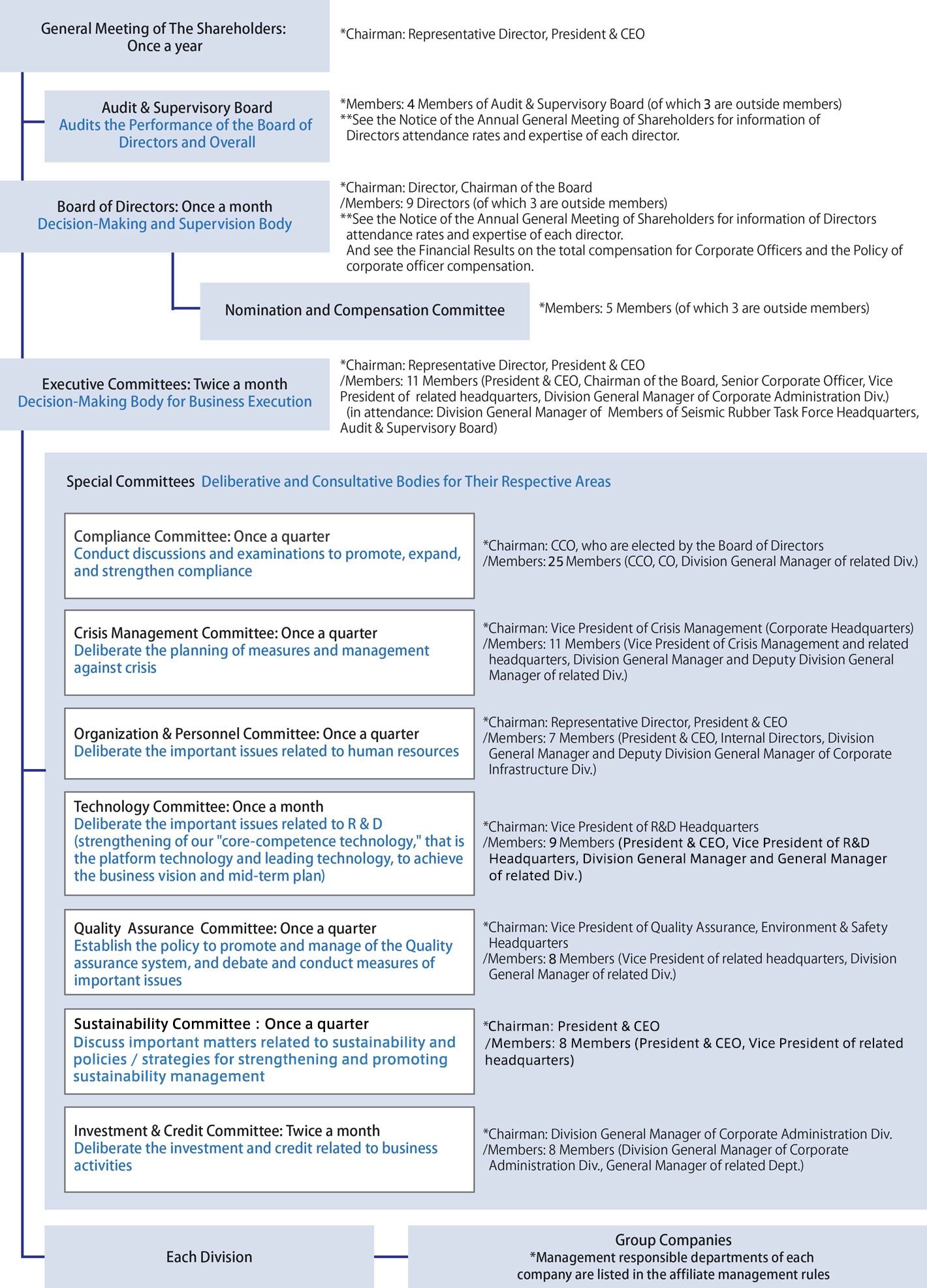

Corporate Governance System

Our corporate governance system comprises the Board of Directors, which is responsible for decision-making and supervision, under which the Nomination & Compensation Committee is placed as an independent advisory organ to the Board of Directors on personnel affairs, compensation, and other matters concerning directors. Also comprising the system are the Executive Committee, which serves as the decision-making body for business execution, the special committees, which act as deliberative and consultative bodies for their respective areas, and the Audit & Supervisory Board, which audits the performance of the Board of Directors and each of its members. Our corporate governance structure allows these organs to fulfill their respective functions and responsibilities effectively.

The number of directors of the Board of Directors shall not exceed 11 to ensure prompt decision-making. In addition, the Company believes that it is essential to give consideration to gender, age, background, skills, and other diversity in the composition of the Board of Directors in order to provide a well-balanced overall level of knowledge, experience, and ability to effectively fulfill its roles and responsibilities.

To incentivize internal directors to pursue the sustainable enhancement of corporate value and ensure that they share said value with our shareholders, we have introduced a monetary compensation receivables system for granting restricted stock to internal directors.

In addition, we appropriately manage conflicts of interest. We have determined that the outside directors appointed by the Company carry no risk of conflicts of interest with general shareholders and reported them as independent directors. Regular independent evaluations of the Board of Directors ensure the functionality and effectiveness of the Board of Directors and various committees.

In April 2021, to enhance and promote our sustainability management, we established a new special committee, the Sustainability Committee, which the Safety & Environment Committee was merged into.

Governance structure *As of April 2021

Internal Control System

In accordance with the Companies Act in Japan, the basic policy on constructing the internal control system was decided by the Board of Directors, and the internal control system was created in line with that basic policy. The basic policy is reviewed each year to reflect changes in the management environment and to ensure that our internal control system remains effective.The content of the review was approved by the Board of Directors.

“Reporting Hotlines” have been established and operated as a system to enable employees to directly report and seek advice regarding their concerns, such as compliance issues that could develop into a crisis. In addition, multiple reporting routes have been secured, and a system that makes it easy for required information to rise to the governance organization has been created.

Risk Management System

As for post-crisis response, we have established a risk management system that the Vice President of Crisis Management (Vice President of Corporate Headquarters) is responsible for as stipulated in the Risk Management Rules. A risk management officer for each material risk that could have a major impact on the Group and stipulates countermeasures for both non-emergency and emergency situations by creating a Risk Management Manual.

When a crisis occurs, the risk management officer convenes the Emergency Response Meeting, decides on the most appropriate response based on the impact the crisis will have on the Group and stakeholders, and resolve the problem.

The Crisis Management Committee, chaired by the Vice President in charge of crisis management, meets four times a year in principle to improve the crisis management system and manage progress. It is reported twice a year to the Executive Committee under the supervision of the Board of Directors.

As for the Group’s subsidiaries and affiliated companies, Affiliated Company Management Rules have been established to strengthen necessary governance in order to increase Group performance and strengthen business while all entities respect the independence of each other. In addition, the managing departments and managers are clearly indicated, operations are streamlined, and management standardized.

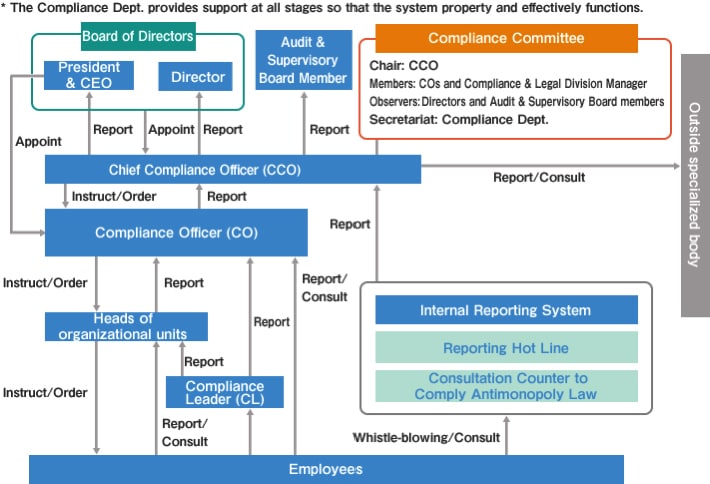

Compliance Promotion System

Within our Group, compliance is deemed a matter of the highest priority in management, and the president works as the party in charge of compliance to create and improve the compliance system.

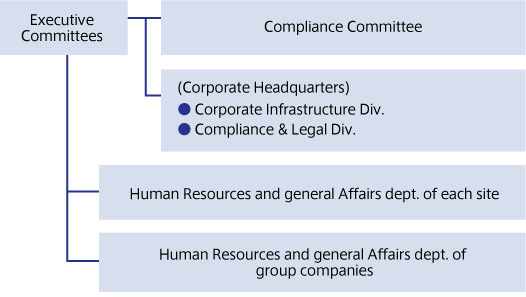

In addition to establishing the Compliance Committee, one of the special committees under the Excutive Comittee that debates and examines issues related to promoting compliance, we have a system of compliance officers and are striving to promote compliance, mainly by the chief compliance officer (CCO), compliance officers (CO), and compliance leaders (CL).

The Compliance Committee is chaired by a CCO appointed by the Board of Directors. Meetings are held four times a year in principle, and the contents of discussions are reported twice a year to the Executive Committee under the supervision of the Board of Directors.

The CCO and COs have the authority to investigate, direct (including suspend business operations and shipping) and make compliance related proposals for the entire Group and the department they are responsible for, respectively. We have also established a system in which the CCO reports to and consults with an external profession organization regarding compliance problems that occur. As assistants to COs, CLs are responsible for promoting various activities in the workplace. CLs are also required to report to their supervisors if they become aware of compliance problems and appropriately respond in accordance with the situation.

We have a structure in place that enables prompt investigation when a compliance issue (or a suspicion of one) is reported to the CO. Efforts related to the investigation and measures implemented to prevent recurrence are announced within the company. We make use of this information as the investigation whether does not have any similar cases (horizontal deployment), reconfirmation of laws and internal rules. And when a similar case occurs, we use it as a reference for solving the issues and for measures to prevent recurrence.

Promotion System of Anti-corruption and Anti-bribery

Our group developed and implemented the Global Policy on Anti-corruption and Anti-bribery in 2019, which targets all types of corrupt activities. We require our suppliers to take measures to prevent corruption through our CSR Procurement Guidelines.

The Compliance Committee, compliance & legal division, purchasing division and general affairs division are responsible for ensuring that policies are disseminated both internally and externally and for monitoring the status of compliance.

- *Toyo Tire Corp.

- * Affiliated companies, the General Affairs manager of each company promotes activities based on the group policy.

TOYO TIRE belongs to the following trade associations:

Grievance Mechanism

- Reporting Hotline (Creating an Internal Control System) * Targets: Employees, Business Partners

- Customer Relations Department * Targets: Customers, Local Communities

- Inquiry Form (on the Website) * Targets: Customers, Shareholders and Investors, NGOs

- Labor-Management Council Meetings * Targets: Employees

- Consultation Desk for Compliance with the Antimonopoly Act * Targets: Employees

- IR meetings * Targets: Shareholder, Investor

Main Resources

- Total compensation for corporate officers (FY2020)

Directors (9 people): 291 million yen *Upper limits of 450 million yen/year

Audit and Supervisory Board members (6 people): 47 million yen *Upper limits of 80 million yen/year* The number of officers and the total amount of their compensation, etc. above includes compensation of 53 million yen to seven outside officers (Outside Directors and Outside Auditors), as well as compensation to three Directors and one Auditor who retired from office during FY2020.

* The total amount of compensation, etc. above includes 100 million yen in provision for directors' bonuses, which was recorded in fiscal 2020.

* The total amount of compensation, etc. for directors above includes 8 million yen in compensation for granting restricted stock. - Compliance Officers (as of April 2021): 25

- Compliance Leaders (as of April 2021): 120

Activities in 2020

Sustainability

- Message from the President

- TOYO TIRE Value creation

- TOYO TIRE Sustainability

-

TOYO TIRE Materiality

- Help create a society of sustainable mobility / Support the enjoyment of mobility for all

- Support diverse talent with motivating challenges and job satisfaction

- Continue innovating next-generation mobility technology

- Pursue decarbonization in all corporate activities

- Promote supply chain sustainability

- Ensure the fundamentals of manufacturing: quality and safety

-

ESG Activities

- E: Environment

- S: Upholding human rights

- S: Managing occupational health and safety to global standards

- S: Crisis management (responding resiliently to natural disasters, infections and other crises)

- S: Working with local communities (Helping solve local issues)

- G: Sound governance

- G: Compliance

- G: Risk management

- G: Information security

- G: Promoting digital transformation (borderless and centralized business management through ERP reform)

- External Recognition

- Report Library

- ESG Data

- ESG Data/Survey Index

- GRI Content Index

- Communication on Progress (CoP) Index

- Editorial Policy